Facts About Pvm Accounting Uncovered

Unknown Facts About Pvm Accounting

Table of ContentsFascination About Pvm AccountingOur Pvm Accounting PDFs4 Simple Techniques For Pvm AccountingRumored Buzz on Pvm AccountingIndicators on Pvm Accounting You Should KnowThe Only Guide for Pvm Accounting

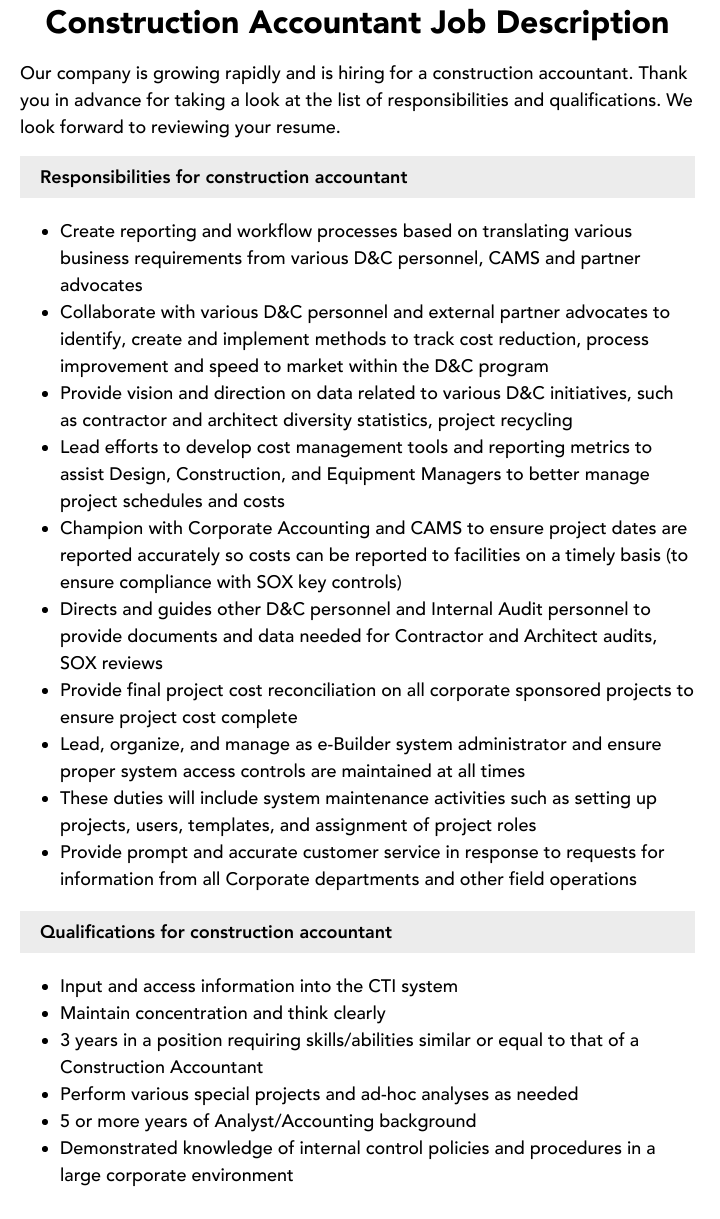

Make sure that the bookkeeping procedure abides with the law. Apply needed building and construction accounting requirements and treatments to the recording and reporting of building activity.Interact with different financing companies (i.e. Title Business, Escrow Business) pertaining to the pay application process and demands needed for payment. Aid with applying and keeping inner economic controls and treatments.

The above declarations are planned to explain the general nature and level of work being carried out by people appointed to this category. They are not to be taken as an extensive checklist of duties, tasks, and skills required. Workers may be called for to do tasks outside of their regular duties once in a while, as required.

6 Easy Facts About Pvm Accounting Described

You will certainly help support the Accel team to guarantee shipment of effective on schedule, on budget plan, projects. Accel is seeking a Construction Accountant for the Chicago Workplace. The Construction Accounting professional carries out a range of accounting, insurance policy compliance, and job management. Works both separately and within certain departments to preserve financial documents and ensure that all records are maintained existing.

Principal duties include, but are not limited to, dealing with all accounting features of the firm in a timely and precise fashion and giving reports and routines to the firm's certified public accountant Firm in the prep work of all financial declarations. Makes certain that all audit procedures and features are managed accurately. In charge of all monetary records, payroll, financial and everyday operation of the bookkeeping function.

Functions with Project Managers to prepare and upload all monthly billings. Creates month-to-month Work Expense to Date records and functioning with PMs to integrate with Task Supervisors' budgets for each task.

9 Easy Facts About Pvm Accounting Described

Efficiency in Sage 300 Construction and Property (previously Sage Timberline Workplace) and Procore building and construction monitoring software program a plus. https://filesharingtalk.com/members/596556-pvmaccount1ng. Must additionally be efficient in various other computer software application systems for the prep work of records, spread sheets and other bookkeeping evaluation that might be needed by administration. construction bookkeeping. Have to possess solid organizational skills and capability to focus on

They are the monetary custodians who guarantee that building and construction tasks continue to be on budget plan, follow tax laws, and maintain monetary transparency. Construction accounting professionals are not simply number crunchers; they are strategic companions in the building and construction process. Their primary role is to handle the financial aspects of construction projects, ensuring that sources are allocated effectively and monetary threats are minimized.

Some Known Incorrect Statements About Pvm Accounting

By preserving a limited grip on job finances, accountants aid avoid overspending and financial obstacles. Budgeting is a keystone of successful building projects, and building and construction accountants are important in this respect.

Construction accountants are skilled in these laws and guarantee Home Page that the task abides with all tax obligation demands. To succeed in the duty of a building accountant, people require a strong instructional structure in bookkeeping and money.

Furthermore, qualifications such as Qualified Public Accounting Professional (CPA) or Licensed Building Sector Financial Professional (CCIFP) are very concerned in the sector. Building jobs often include limited target dates, altering regulations, and unexpected expenditures.

9 Easy Facts About Pvm Accounting Shown

Ans: Building accountants develop and keep track of budget plans, determining cost-saving opportunities and making certain that the job remains within budget plan. Ans: Yes, building and construction accounting professionals handle tax conformity for construction jobs.

Intro to Building And Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction firms have to make tough choices amongst numerous economic alternatives, like bidding on one task over one more, picking funding for materials or tools, or setting a job's profit margin. Building and construction is an infamously volatile market with a high failing price, slow time to settlement, and inconsistent cash money circulation.

Normal manufacturerConstruction business Process-based. Production includes repeated procedures with easily recognizable costs. Project-based. Manufacturing needs different procedures, products, and devices with differing expenses. Fixed area. Production or manufacturing occurs in a solitary (or several) regulated locations. Decentralized. Each project takes area in a new location with differing website problems and distinct obstacles.

A Biased View of Pvm Accounting

Constant usage of various specialized service providers and distributors influences effectiveness and money circulation. Settlement shows up in full or with regular payments for the full agreement amount. Some section of payment may be withheld till task conclusion even when the contractor's job is ended up.

Routine production and temporary contracts cause manageable cash circulation cycles. Irregular. Retainage, slow payments, and high upfront prices cause long, irregular cash money flow cycles - financial reports. While typical makers have the advantage of regulated environments and maximized production processes, building and construction business should constantly adjust to each brand-new project. Also somewhat repeatable jobs require adjustments due to site problems and other aspects.